The U.S. government has officially resumed garnishing Social Security benefits to collect unpaid federal student loans, a move that could deeply affect older Americans living on limited retirement income. This decision, which had been paused during the pandemic, is now back in action, leaving many seniors worried about their monthly checks being reduced.

Why Is This Happening Now?

During the COVID-19 pandemic, the U.S. Department of Education put a temporary stop to collections on federal student loans. This included garnishments of wages and Social Security payments. The pause was part of the broader effort to support Americans facing financial hardship.

However, in April 2024, the Education Department quietly announced that it would resume these garnishments for those who remain in long-term default. According to the Department, collections began again in May 2025, ending the pandemic-related relief.

Who Is Affected?

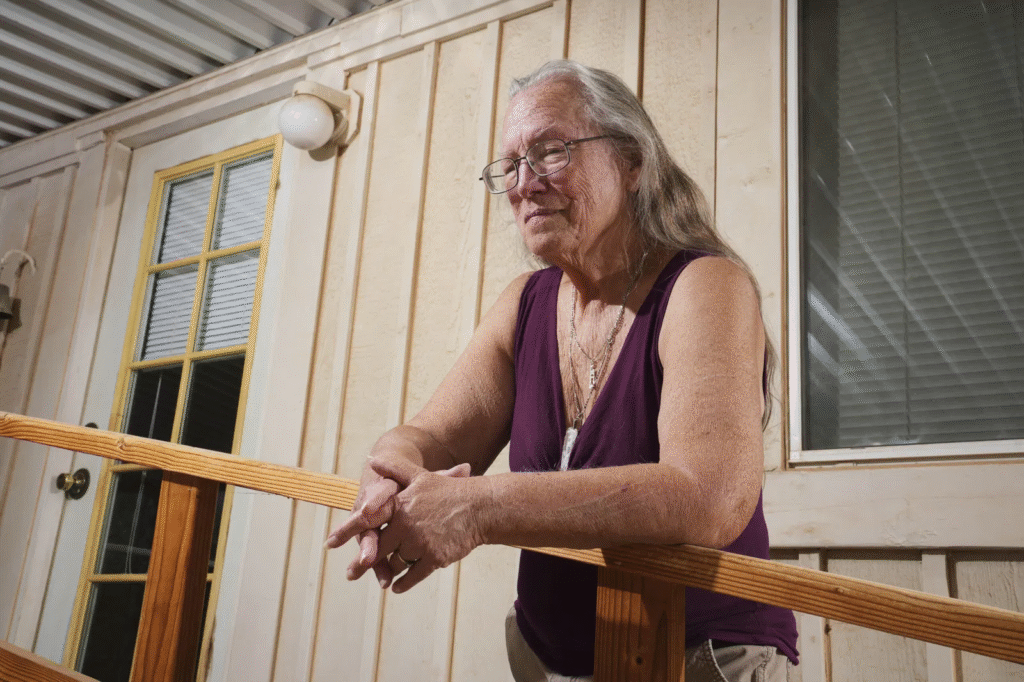

The people most affected are older Americans who have defaulted on their federal student loans and receive Social Security benefits. According to the Government Accountability Office (GAO), around 114,000 Social Security recipients had portions of their checks garnished for student loan repayment in 2015. That number was expected to rise before the pandemic hit.

These are not young borrowers. Many are in their 60s, 70s, and even 80s. Some took out loans for their own education. Others borrowed to help children or grandchildren go to college and were unable to pay them back.

How Much Can the Government Take?

The government can legally withhold up to 15% of a person’s monthly Social Security check to recover unpaid student loans. However, there is a rule that at least $750 must be left for the person to live on each month. But with inflation and rising living costs, that minimum amount is no longer enough for many to cover their basic needs.

This garnishment doesn’t just reduce income; it can push already struggling seniors deeper into poverty. Many rely heavily on Social Security as their main or only source of income.

why is this a problem?

Advocacy groups and some lawmakers argue that garnishing Social Security is cruel and counterproductive. Seniors living in or near poverty are being asked to repay debts from decades ago. In some cases, they are paying loans they co-signed but never used themselves.

The National Consumer Law Center (NCLC) and other organizations have urged Congress to pass laws preventing this kind of garnishment. They argue that Social Security is meant to be a safety net, not a source of debt repayment.

What Are the Alternatives?

There are some protections and repayment options available for seniors, but many don’t know about them:

- Income-Driven Repayment (IDR) Plans: These plans set monthly payments based on income and family size. For many retirees with low income, payments can be as low as $0.

- Loan Forgiveness for Disability: If a person is permanently disabled, they may qualify to have their loans forgiven.

- Fresh Start Program: In 2022, the Department of Education launched the Fresh Start program, which allows borrowers in default to return to good standing and avoid collections. But participation requires action from the borrower.

You can learn more about Fresh Start and IDR plans on the Federal Student Aid website.

What Can Seniors Do?

- Contact the Loan Servicer: Seniors should reach out to their loan servicer or the Education Department to explore their options.

- Apply for IDR or Fresh Start: These programs can stop garnishments and reduce monthly payments to zero for low-income individuals.

- Get Legal Help: Legal aid organizations can help seniors navigate the system and prevent unjust garnishment.

Lawmakers Push for Reform

Several members of Congress have introduced bills to stop Social Security garnishments for student loans. In 2022, the “Stop the Student Loan Tax Relief Act” was introduced, but it has not yet passed. Advocates are calling for renewed attention as thousands of seniors are set to lose part of their income again.

Conclusion

As student loan collections restart, elderly Americans face a fresh wave of financial pressure. Garnishing Social Security benefits for old debts is raising ethical and economic questions. If you or a loved one is affected, it’s important to take action now. Explore forgiveness options, contact your loan servicer, and seek help to protect your retirement income.